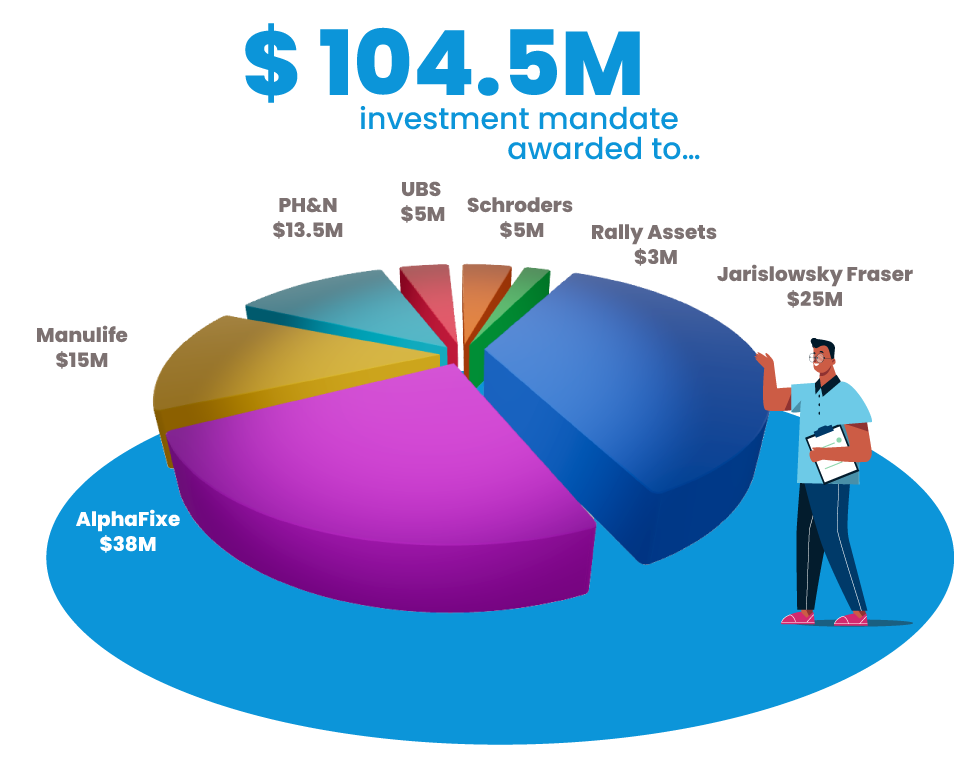

As co-investors of the Great Canadian ESG Championships – a responsible investing competition developed and led by the Trottier Foundation – we are pleased to announce the winners of the $104.5M investment mandate, as well as the release of the Championship’s State of the Industry report, which takes a deep dive into the key trends and best practices of ESG investing observed throughout the initiative.

We are pleased to announce that the McConnell Foundation invested $15M with AlphaFixe Capital – a leading fixed income investment manager and signatory to the United Nations Principles for Responsible Investment (UNPRI). Our investment in AlphaFixe Capital’s Green Bond Fund allows us to support green infrastructure and energy efficiency projects led by companies, regional and federal governments or supranational organizations.

Launched in March, The Great Canadian ESG Championship was a dragons-den style competition developed by nine Canadian institutional investors as a response to the growing number of asset owners looking for responsible investment opportunities in a market that lacked clarity around ESG standards and labelling. The goal of the championship was to shine a light on the asset managers who are excelling in responsible investing so they can inspire others, and to give asset owners a curated jumping-off point to help accelerate their ESG investing.

The winning asset management firms ranged from large to small and were awarded based on their fund’s performance that met both high financial and high ESG criteria. Their rankings were also based on whether the fund’s strategy met the individual investment priorities and ESG goals of the co-investors. The winning firms allocated a piece of the total $104.5M investment pool included Alphafixe, Rally Assets, Jarislowsky Fraser, Schroders, UBS, Manulife and PH&N Institutional.

State of the Industry Report

The completion of The Great Canadian ESG Championship comes at a pivotal time in the face of increased scrutiny around greenwashing in ESG investing and the global tightening of regulations for ESG financial products. While the appetite for responsible investment options in Canada has never been greater, neither has skepticism around what constitutes credible ESG.

Findings and key learnings from the competition in the rapidly evolving global ESG landscape are captured in the Millani-authored State of the Industry Report. The report highlights the need for clarity in communications from asset managers and comprehensive standards from regulators in order for the market to keep a strong footing and remain competitive. It also makes clear recommendations for how we can build more trust and transparency in the market.